Introduction

In warehousing, the conversation is changing. For many teams, the question is shifting from how to grow to how to get more value from what already exists.

Warehouse strategy is no longer about expansion for its own sake. In a tighter, more competitive market, the priority has become clear: maximize the return on what you already operate.

Recent data from the Real Estate Market Cycle Monitor shows that industrial property in the United States, including warehousing, has moved into a state of oversupply. Occupancy is falling. Rent growth is slowing. Several regions are already showing signs of contraction. While the report focuses on the U.S., the core pressures, flattening demand, excess capacity, and increased scrutiny on capital are global in scope.

This is not a moment for fear. It is a moment for precision. When growth slows, the teams that win are the ones that make better decisions. And that starts with visibility.

What the Cycle Tells Us About Warehouse Strategy in 2025

"In hypersupply, supply outpaces demand. Occupancy falls. Rents flatten. Precision becomes your advantage."

The Real Estate Market Cycle Monitor maps commercial property sectors across four phases: Recovery, Expansion, Hypersupply, and Recession. Each phase reflects how supply and demand interact to shape occupancy and rental trends. Warehousing in the United States is now deep into the third phase: Hypersupply.

In this phase, new space continues to enter the market even as demand starts to soften. Over 312 million square feet of new industrial space came online in the past year, significantly outpacing demand growth Occupancy rates begin to fall. Nationally, industrial occupancy dropped 0.2% in the first quarter alone, and 0.9% over the past year, continuing a steady decline. Rent growth slows or flattens. Rent growth has also cooled significantly, rising just 0.6% last quarter—a sharp slowdown that underscores softening demand even as supply increases. Some regions hold steady, while others move into contraction. Operators who once competed to secure more space are now under pressure to operate more effectively within current constraints.

That shift introduces risk. When the market was expanding, there was more room for trial and error. In a hypersupply environment, the cost of guessing wrong, whether on layout changes, automation investments, or labor plans, can quickly become too high to absorb.

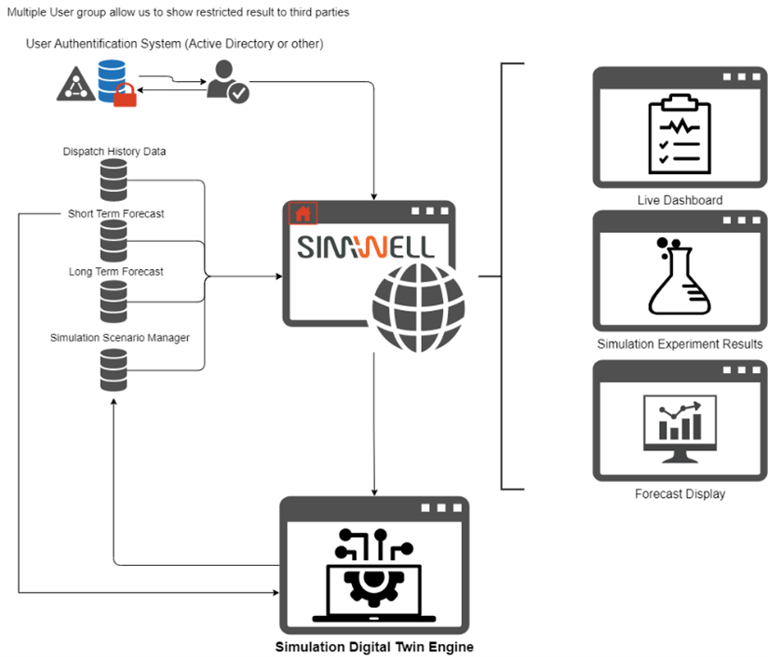

This is where simulation becomes essential. It gives warehouse teams the ability to forecast performance impacts before making operational changes. Whether the goal is to consolidate facilities, increase throughput, or avoid new capital expenses, simulation provides a risk-free way to understand what those changes will actually deliver. It turns planning into a source of confidence, not uncertainty.

What Simulation Lets You See Before You Spend

In a hypersupply market, operational drag becomes a hidden cost. Simulation helps you surface that risk and break the cycle before it slows you down.

Simulation allows warehouse teams to evaluate operational adjustments in a virtual environment. These changes often involve tradeoffs across layout, labor, automation, and capital. Understanding those tradeoffs in advance helps avoid wasted investment and missed targets.

Here are just a few of the questions simulation helps answer:

- What is the cost impact of delaying an expansion while reconfiguring current space?

- Can we consolidate two facilities and maintain throughput without adding shifts?

- Which automation investments improve performance without requiring more square footage?

Each of these scenarios becomes more important in a market defined by hypersupply. When growth is no longer a given, the ability to model cost, performance, service levels, and capital impact becomes a source of strategic advantage. Simulation helps teams identify and prioritize changes that deliver the greatest return under tighter conditions.

Simulation helps you prioritize clearly. But knowing what to change isn't enough. In a hypersupply market, execution matters just as much as insight.

Turning Simulation Into a Strategic Advantage

In a market defined by hypersupply, simulation is not just a planning tool. It is a way to build operational alignment and reduce the time it takes to move from idea to execution.

Warehouse decisions often involve cross-functional teams. Operations, engineering, finance, and automation stakeholders each bring different perspectives and priorities. Simulation provides a shared model where scenarios can be explored together, with real outcomes visible before any changes are made. This helps reduce internal debate, surface tradeoffs early, and accelerate cross-functional decision-making.

It also improves execution. When teams see the full picture before making a decision, they are better positioned to act quickly and confidently. Simulation reduces false starts, rework, and the slow erosion of ROI that comes from misaligned plans.

In a growth market, speed often covers for inefficiency. But in hypersupply, every investment draws more scrutiny. Simulation gives warehouse leaders a way to validate ideas and reduce delays. In a market where margins are thinner and capital carries more weight, that speed and clarity become a competitive edge.

Conclusion

The warehouse market has entered a new phase, one where excess space, slowing demand, and tighter capital oversight define the landscape. In this environment, the most successful teams will not be the ones that grow the fastest, but the ones that adapt the smartest.

Simulation supports that shift by helping teams identify what is most likely to work before any investment is made. It removes guesswork, clarifies tradeoffs, and equips decision-makers to act with purpose. In a hypersupply market, that clarity is more than helpful, it is essential.

In a cycle defined by excess, clarity becomes your most valuable asset. Simulation provides it.

Want to see how simulation could help you adapt in a hypersupply market? Talk to a SimWell specialist or explore our warehouse modeling playbook.

Are you ready to unlock the power of simulation digital twins for your organization? Let’s start the conversation!

DOWNLOAD THE LATEST RESOURCE WE PREPARED FOR YOU

Discover how simulation helps answer critical What-If questions, optimize decisions, and navigate uncertainty with confidence. Explore eight key question types that drive smarter, data-backed business strategies.